很多同学在开始学习present value时,常常会不知道什么时候查复利现值系数表,什么时候查年金现值系数表;也常常不确定这个折现究竟折现到什么时候;这些基础的问题没有弄清楚,当题目稍微变得不那么常规时,很多同学就不知道该怎么处理了。

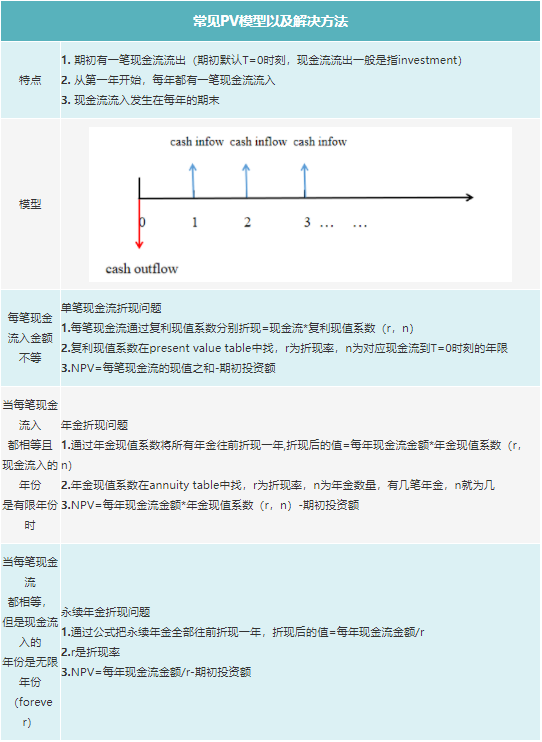

那么针对这些问题,给大家在下面的表格中总结了三种常见的折现问题及其处理方法。

常见PV模型以及解决方法

题目

接下来,分别给三个题目让大家练习一下:

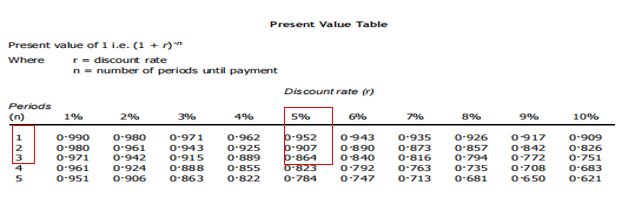

例1:An investment of$20,000 is expected to yield$5,000 in the first year,$10,000 in the second year,$8,000 in the third year.Calculate the net present value of the investment opportunity if the cost of capital is 5%

NPV=5000*复利现值系数(5%,1)+10000*复利现值系数(5%,2)+8000*复利现值系数(5%,3)-20000

=5000^0.952+10000^0.907+8000^0.864-20000

=$742

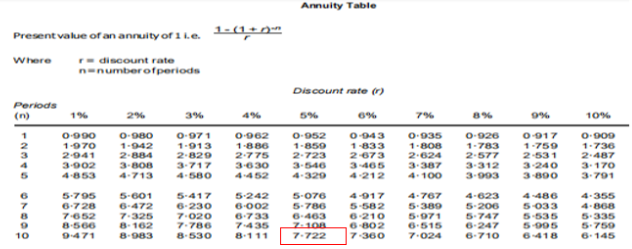

例2:An investment of$50,000 is expected to yield$5,000 for ten years.Calculate the net present value of the investment opportunity if the cost of capital is 5%.

NPV=50000*年金现值系数(5%,10)-50000

=5000^7.722-50000

=-$11390

例3:An investment of$50,000 is expected to yield$5,000 per annum in perprtuity.Calculate the net present value of the investment opportunity if the cost of capital is 5%.

NPV=5000/5%-50000

=$50000

以上,就是针对present value中三种常见问题的总结

各大税种的计算公式合集

各大税种的计算公式合集